Bruce ATS™: Empowering Retail Investors Through Odd-Lot Transparency

September 07, 2025 - Chicago, IL

Bruce Markets LLC, operator of Bruce ATS™, is pleased to announce an exciting enhancement to its market data product. Effective Sept. 7, 2025, Bruce Markets’ Best Bid and Offer (“BBO”) feed, otherwise known “Top-of-Book,” now includes and publishes individual odd-lot orders as the BBO quote, should the odd-lot order represent the best available price. This change empowers investors with better, more comprehensive data, equipping them to make smarter decisions.

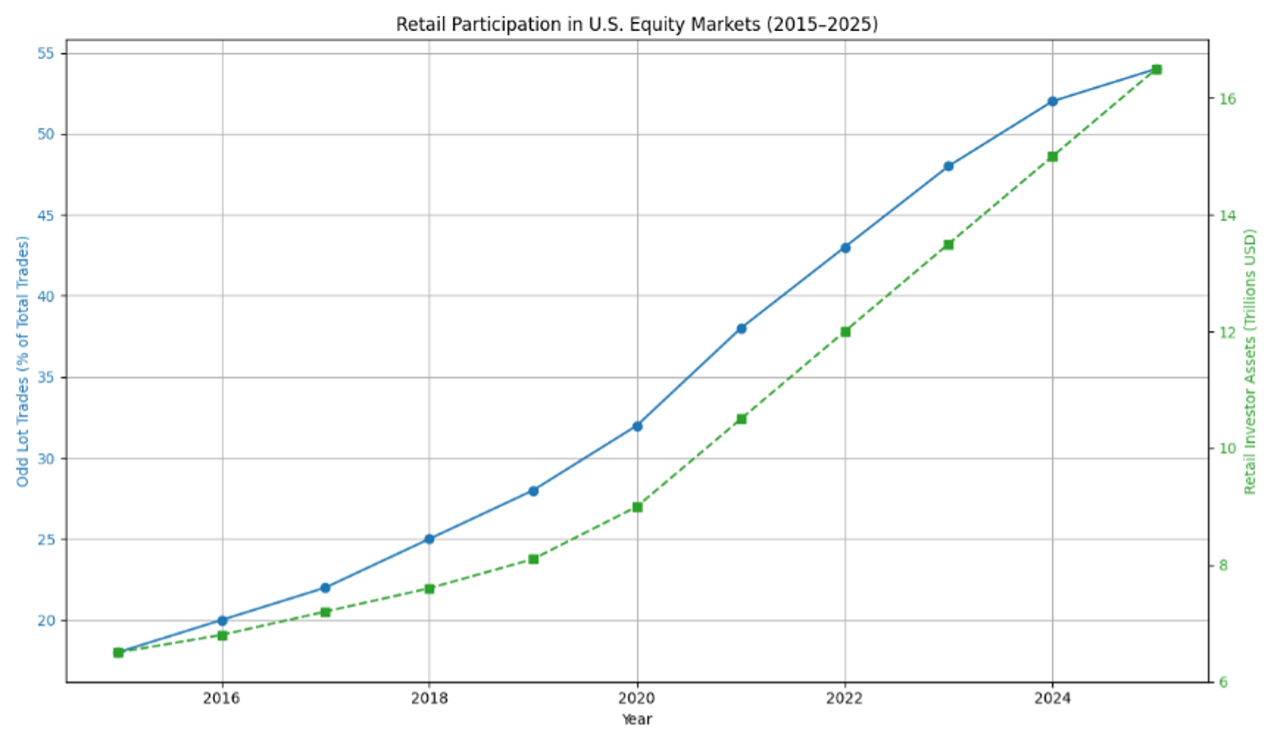

Bruce ATS, an overnight marketplace for trading U.S. Reg NMS securities, is owned by a consortium of industry-leading retail brokers and financial technology providers. As such, Bruce ATS is built to serve the interests of the retail investors. In recent years, retail has risen to represent over 20% of the total U.S. equity market. The birth of 24-hour equity trading not only serves as continued modernization of U.S. capital markets, but also as a sign that the retail voice is now in position to evolve our market structure based on the growing demand of the retail investor.

Why Odd-Lot Transparency Matters

This enhancement is a meaningful step forward in how retail investors around the world are served. It sets a new standard for retail trading—one that reflects Bruce’s commitment to innovation and customer trust—through transparency, accuracy, and customer empowerment.

Traditionally, U.S. equity markets have prioritized round-lot orders (multiples of 100 shares) in public quote dissemination. However, with the rise of notional trading—where investors trade based on dollar amounts rather than share quantities—odd-lot orders (fewer than 100 shares) have become the norm for retail participants.

(References: Individual Traders (“Retail”) in the US Stock Market; Retail Investing Statistics 2025: Key Trends Shaping the Market)

- Over 50% of trades on U.S. exchanges are now odd-lots.

- Retail investors often trade in fractional shares or small dollar amounts.

- Odd-lot quotes are excluded from the NBBO, limiting visibility into true market pricing.

“This enhancement delivers important benefits to retail brokers and their customers,” said Jason Wallach, Bruce Markets CEO. “By publishing odd-lot orders as part of our core BBO market data feeds, we are building a retail-friendly market ecosystem and redefining market data standards.”

Bruce ATS’s Innovative Approach

Legacy BBO feed logic across wall street prioritizes display of round-lot or larger order quantities and in many cases ignores odd-lot sized liquidity. By displaying odd-lot orders at the top-of-book, Bruce ATS delivers increased transparency into available liquidity and prices that are aligned with typical retail order profiles. “Optimization of investor experience with a data product specifically designed for retail promotes enhanced analytics and better-informed investment opportunities and portfolio management,” said Wallach. “This initiative ensures that retail-sized orders are visible, actionable, and reflective of the best available prices.” Bruce ATS can benefit you and your customers. To learn more, reach out to us at support@brucemarkets.com.

About Bruce ATS™

Bruce ATS™, operated by SEC and FINRA-registered broker-dealer Bruce Markets™, is an Alternative Trading System offering secure overnight access to U.S. markets. Bruce ATS™ provides financial institutions with seamless integration and scalable solutions. Designed for reliability and performance at enterprise scale, Bruce ATS™ redefines after-hours trading by bridging the gap between investors and U.S. markets, empowering firms to extend trading opportunities beyond traditional hours with confidence and ease. For more information, visit www.brucemarkets.com.